number1411/iStock via Getty Images

In this analysis, we examine Truist Financial Corporation (NYSE:TFC), a regional bank based in the US, to determine its suitability as an investment for fixed-income investors. We examine whether the company has stable and solid fundamentals, as well as a competitive advantage as a regional bank that could support its growth outlook. Additionally, we evaluate the company’s strong financial position in terms of asset quality and analyze the company’s loan breakdown. Lastly, we compare Truist Financial’s credit rating and yield as one of the top regional banks with those of other regional banks and top financial companies.

Segment Growth Performance

In the first section, we determine whether the company has stable and solid fundamentals with a competitive advantage as a regional bank that could support its growth outlook.

We compiled and analyzed the company’s segment breakdown and performance over the past 10 years, in terms of Consumer Banking and Wealth, Corporate & Commercial Banking, and Insurance segments below.

|

Revenue By Segments ($ mln) |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

H1 2024 |

Average 9Y |

|

Consumer Banking and Wealth |

4,759 |

4,968 |

5,863 |

6,872 |

12,857 |

12,874 |

13,599 |

14,105 |

6,241 |

|

|

Growth % YoY |

12% |

4% |

18% |

17% |

87% |

0% |

6% |

4% |

-2% |

8.70% |

|

Corporate and Commercial Banking |

4,201 |

4,433 |

3,632 |

3,912 |

7,654 |

8,531 |

8,822 |

9,115 |

5,351 |

|

|

Growth % YoY |

15% |

6% |

-18% |

8% |

96% |

11% |

3% |

3% |

-2% |

4.03% |

|

Insurance |

1,798 |

1,854 |

1,959 |

2,214 |

2,335 |

2,658 |

3,118 |

3,157 |

0 |

|

|

Growth % YoY |

7% |

3% |

6% |

13% |

5% |

14% |

17% |

1% |

0% |

8.80% |

|

Other, Treasury and Corporate |

35 |

62 |

104 |

-430 |

-141 |

-1,767 |

-2,504 |

-2,987 |

-8,459 |

|

|

Growth % YoY |

67% |

77% |

68% |

-513% |

67% |

-1153% |

-42% |

-19% |

-445% |

-216.59% |

|

Total |

10,793 |

11,317 |

11,558 |

12,568 |

22,705 |

22,296 |

23,035 |

23,390 |

3,133 |

|

|

Growth % YoY |

12% |

5% |

2% |

9% |

81% |

-2% |

3% |

2% |

-69% |

4.44% |

Source: Company Data, Khaveen Investments

Based on the table above, the company’s growth performance has been stable with an average growth rate of 4% over the past 9 years. In 2020, its revenues surged by 81% following the merger with BB&T Corporation. In terms of its segment performance, the Insurance segment had the highest average growth rate for the past 9 years at 8.80%. However, Truist had divested its Insurance business recently in May this year. Followed by Insurance, the Consumer Banking and Wealth segment had the 2nd highest average growth of 8.70% for the past 9 years, above the total average growth. Moreover, the Corporate and Commercial Banking segment underperformed the total company growth average (only 4%). Furthermore, the Other, Treasury and Corporate segment, which consists of treasury operations, corporate functions, and non-core activities of the bank, recorded losses in the past 3 years such as its $6.7 bln in realized securities losses in H1 2024. The $6.7 bln in loss represented the difference between the book and realized value when Truist sold $27.7 bln of “lower-yielding investment securities”, which originally had $34.4 bln in book value. We further examined the company’s growth metrics by its Consumer Banking and Wealth and Corporate and Commercial Banking segments in terms of net interest income, net interest margin, and non-interest income.

Consumer Banking and Wealth Segment

|

Consumer Segment ($ mln) |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

H1 2024 |

Average 9Y |

|

Consumer Net Interest Income |

2,916 |

3,405 |

3,564 |

3,816 |

4,556 |

8,801 |

9,186 |

10,181 |

10,795 |

5,231 |

|

|

Growth % YoY |

17% |

5% |

7% |

19% |

93% |

4% |

11% |

6% |

-2% |

9.9% |

|

|

Consumer Non Interest Income |

1,342 |

1,354 |

1,404 |

2,047 |

2,316 |

4,056 |

3,688 |

3,418 |

3,310 |

1,010 |

|

|

Growth % YoY |

1% |

4% |

46% |

13% |

75% |

-9% |

-7% |

-3% |

-5% |

6.3% |

|

|

Consumer Revenue |

4,258 |

4,759 |

4,968 |

5,863 |

6,872 |

12,857 |

12,874 |

13,599 |

14,105 |

6,241 |

|

|

Growth % YoY |

12% |

4% |

18% |

17% |

87% |

0% |

6% |

4% |

-2% |

8.7% |

|

|

Consumer Banking and Wealth Loans |

62,358 |

64,142 |

61,374 |

64,000 |

130,503 |

123,054 |

121,829 |

133,159 |

122,020 |

119,775 |

|

|

Growth % YoY |

3% |

-4% |

4% |

104% |

-6% |

-1% |

9% |

-8% |

-5% |

15.24% |

|

|

Net Interest Margin |

4.68% |

5.31% |

5.81% |

5.96% |

3.49% |

7.15% |

7.54% |

7.65% |

8.85% |

8.74%* |

6.37% |

Source: Company Data, Khaveen Investments

Based on the table above, the company’s Consumer segment growth has been primarily driven by net interest income growth with an average of 9.9%. On the other hand, the segment’s average non-interest income growth was lower than net interest income growth. Besides, the total loan balance shows a high average growth of 15.2%. However, this is boosted by the strong growth performance of 104% in 2019 due to the merger. Excluding 2019, its average loan growth for the segment is only -0.4%. Instead, the company’s net interest margin rose over the period, from 4.68% to 8.85% in 2023. In 2020, the company’s net interest margin jumped to 7.15% and had been higher in the subsequent years compared to before its merger, indicating a positive impact from the merger on its net interest margin. Additionally, management highlighted the increase in net interest margin also due to improving deposit costs and higher short-term interest rates.

Corporate & Commercial Segment

|

Corporate & Commercial Segment ($ mln) |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

H1 2024 |

Average 9Y |

|

Corporate & Commercial Net Interest Income |

2,222 |

2,661 |

2,829 |

2,613 |

2,744 |

5,178 |

5,346 |

6,152 |

6,769 |

3,377 |

|

|

Growth % YoY |

20% |

6% |

-8% |

5% |

89% |

3% |

15% |

10% |

-6% |

7.4% |

|

|

Corporate & Commercial Non Interest Income |

1,436 |

1,540 |

1,604 |

1,019 |

1,168 |

2,476 |

3,185 |

2,670 |

2,346 |

1,974 |

|

|

Growth % YoY |

7% |

4% |

-36% |

15% |

112% |

29% |

-16% |

-12% |

7% |

-1.4% |

|

|

Corporate & Commercial Revenue |

3,658 |

4,201 |

4,433 |

3,632 |

3,912 |

7,654 |

8,531 |

8,822 |

9,115 |

5,351 |

|

|

Growth % YoY |

15% |

6% |

-18% |

8% |

96% |

11% |

3% |

3% |

-2% |

4.0% |

|

|

Corporate and Commercial Banking Loans |

73,593 |

79,180 |

82,327 |

85,013 |

169,339 |

176,680 |

167,684 |

192,832 |

190,041 |

185,917 |

|

|

Growth % YoY |

8% |

4% |

3% |

99% |

4% |

-5% |

15% |

-1% |

-5% |

17.50% |

|

|

Net Interest Margin |

3.02% |

3.36% |

3.44% |

3.07% |

1.62% |

2.93% |

3.19% |

3.19% |

3.56% |

3.64%* |

3.06% |

Source: Company Data, Khaveen Investments

Similarly, the company’s Corporate & Commercial segment growth is also primarily driven by net interest income growth with an average of 7.4%, higher than average non-interest income growth which has an average growth of -1.4%. However, the company’s loan growth for this segment has been better than its Consumer segment, with an average of 17.5% and 4% excluding 2019 due to the effect of the merger. Additionally, its net interest margin had been relatively stable, with an average of 3.06% over the period. However, it was the highest in 2023 at 3.56% and H1 at 3.64% based on annualized interest income, which, we believe, could be due to the elevated interest rates in the US of an average of 5.02% in 2023, the highest in the past 10 years.

Market Share

FDIC, Khaveen Investments

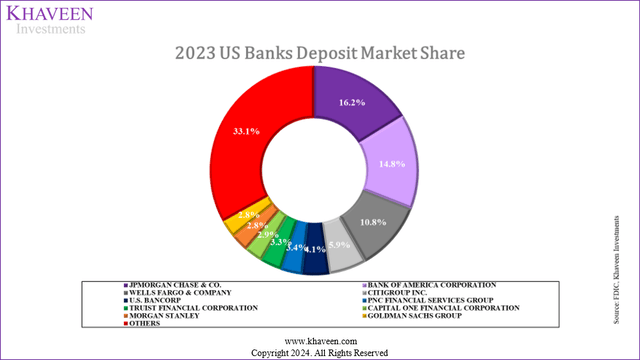

Based on the chart above, the top 10 Financial companies are listed by deposit market share. Among the companies, there are 3 regional banks including Truist Financial, US Bancorp (USB), and PNC Financial (PNC). According to GICS, Regional Banks are commercial banks whose business is mainly “conventional banking operations such as retail banking, corporate lending and originating various residential and commercial mortgage loans funded mainly through deposits”. Furthermore, regional banks “tend to operate in limited geographic regions”. For example, US Bancorp primarily focuses on the West and Midwest regions of the US, with branches in major states such as California, Illinois, and Ohio. Moreover, PNC Financial’s retail banking operations generally focus more on the Northeast, South, and some areas in the Midwest of the US.

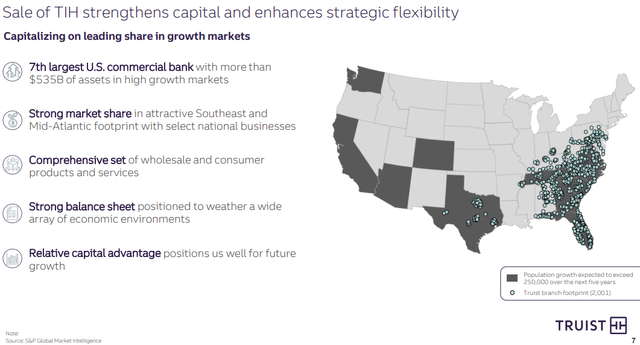

Truist

On the other hand, Truist primarily caters to the Southeast region (including Pennsylvania and Texas). US Bancorp ranks 5th in terms of the market share of deposits and leads the 3 regional banks, followed by PNC at 6th and Truist at 7th. While the South region has the highest share of population breakdown (39%), the West is the second largest (23.6%). Moreover, Truist and PNC compete directly against each other in the South, as both have exposure there. Therefore, we believe a factor that contributes towards US Bancorp’s competitive position, the highest in terms of market share, could be due to its unique focus on the West (where both Truist and PNC do not have exposure to) encompassing major states such as California, the largest US state by GDP.

Competitive Analysis

Moreover, we then compile and analyze the company and its top 10 regional banks by revenue in terms of their customer ratings (Better Business Bureau® rating), savings rate attractiveness (interest expenses as % of deposits), accessibility (number of bank branches and regions/states serviced) to determine whether Truist has a competitive advantage.

|

Banking Ratings |

BBB Rating |

US Regions |

Number of US Branches |

Interest Expense % Deposits (2023) |

Average Ranking Score |

Ranking |

|

US Bancorp |

B |

28 |

2,285 |

2.5% |

4.5 |

4 |

|

Truist |

A+ |

18 |

2,001 |

3.5% |

2.3 |

2 |

|

PNC |

A+ |

29 |

2,318 |

3.0% |

1.5 |

1 |

|

Fifth Third Bancorp |

A+ |

11 |

1,091 |

2.3% |

4.8 |

3 |

|

First Citizen (FCNCA) |

B |

31 |

615 |

2.5% |

5.5 |

5 |

|

Citizens (CFG) |

B+ |

15 |

1,056 |

2.2% |

6.5 |

8 |

|

M&T (MTB) |

A+ |

13 |

933 |

1.9% |

6.3 |

7 |

|

Regions Financial Corp (RF) |

A |

15 |

1,273 |

1.2% |

6.5 |

8 |

|

Huntington Bancshares (HBAN) |

A+ |

11 |

1,000 |

2.3% |

5.5 |

5 |

|

Zions Bank (ZION) |

A+ |

3 |

121 |

2.0% |

7.3 |

10 |

|

Average |

17 |

1,269 |

2.3% |

Source: Better Business Bureau, Company Data, Khaveen Investments

Based on the table above, Truist is tied with several competitors with the highest Better Business Bureau rating at A+, which could suggest high customer satisfaction whereas US Bancorp and First Citizen have the lowest rating of B among competitors. In terms of accessibility, Truist operates in 18 states across the US, placing it 4th among competitors but 3rd in the number of banking branches. Although First Citizen operates in more states than Truist, it has a lower number of branches. Furthermore, Truist tops out competitors in terms of interest expense % of deposits indicating its savings rate attractiveness. Overall, we derived a ranking of these factors where Truist is 2nd overall, beating out all regional bank competitors except PNC, Truist’s high ranking is attributed to its strength in customer satisfaction and relatively high-savings rate attractiveness.

Outlook

All in all, we determined the company’s revenue growth had been primarily supported by two segments, which are its Insurance segment and Consumer segment. However, following the divestiture of its Insurance segment, we expect that the company will be primarily dependent on both its Consumer and Corporate & Commercial, whereby Consumer revenues represented 54% of Truist’s H1 2024 revenues excluding OT&C, and Corporate & Commercial represented the remaining 46%. Furthermore, we determined its Consumer and Corporate & Commercial segments’ growth was mainly driven by net interest income growth with an average of 9.9% and 7.4% respectively, highlighting its reliance on its lending businesses. For the Consumer segment, we highlighted its growth was favorably supported by higher net interest margins from 4.7% to 8.9%, while we determined its Corporate & Commercial segment had relatively higher loan growth at an average of 4% excluding 2019. In terms of competitiveness, we believe Truist has several advantages over other top regional banks, with high customer satisfaction and savings rate attractiveness. However, we see the company trailing behind PNC Financial with greater accessibility due to a wider presence of operations and a larger number of bank branches than Truist. Additionally, we believe US Bancorp also has a geographical advantage by having a significant focus on the West US region, the only bank to operate there among the top 3.

Strong Asset Quality

Next, we examine whether the company has a strong financial position in terms of asset quality. This is because of the company’s divestiture of its Insurance business as highlighted in the first section; thus the company would now be focusing on its Consumer and Commercial & Corporate segments, which we highlighted had been driven by interest income growth. We first examined the company’s loan breakdown by type to analyze its loan growth performance in the past 10 years below.

Loan Portfolio Breakdown – Consumer Banking and Wealth Segment

|

Consumer Segment Loan Breakdown ($ mln) |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

H1 2024 |

Average 9Y |

Average 9Y (Excluding 2019) |

|

Residential Mortgage |

30,533 |

29,921 |

28,725 |

31,393 |

52,071 |

47,272 |

47,852 |

56,645 |

55,492 |

54,344 |

||

|

Growth % YoY |

-2% |

-4% |

9% |

66% |

-9% |

1% |

18% |

-2% |

-4% |

9.7% |

1.66% |

|

| Home Equity |

11,341 |

12,295 |

12,088 |

11,775 |

27,044 |

26,064 |

25,066 |

25,432 |

10,053 |

9,772 |

||

|

Growth % YoY |

8% |

-2% |

-3% |

130% |

-4% |

-4% |

1% |

-60% |

-6% |

8.4% |

-8.90% |

|

|

Indirect Auto |

12,139 |

13,342 |

11,641 |

11,282 |

24,442 |

26,150 |

26,441 |

27,951 |

22,727 |

21,994 |

||

|

Growth % YoY |

10% |

-13% |

-3% |

117% |

7% |

1% |

6% |

-19% |

-15% |

13.2% |

-1.54% |

|

|

Other Consumer |

4,914 |

5,222 |

5,594 |

6,143 |

17,843 |

18,729 |

17,663 |

18,264 |

28,647 |

28,677 |

||

|

Growth % YoY |

6% |

7% |

10% |

190% |

5% |

-6% |

3% |

57% |

0% |

34.1% |

11.82% |

|

|

Credit Card |

3,431 |

3,362 |

3,326 |

3,407 |

9,103 |

4,839 |

4,807 |

4,867 |

5,101 |

4,988 |

||

|

Growth % YoY |

-2% |

-1% |

2% |

167% |

-47% |

-1% |

1% |

5% |

3% |

15.6% |

-6.01% |

|

|

Consumer Banking and Wealth Loans |

62,358 |

64,142 |

61,374 |

64,000 |

130,503 |

123,054 |

121,829 |

133,159 |

122,020 |

119,775 |

||

|

Growth % YoY |

3% |

-4% |

4% |

104% |

-6% |

-1% |

9% |

-8% |

-5% |

12.6% |

-0.42% |

Source: Company Data, Khaveen Investments

From the table, the Consumer segment’s loan portfolio shows its exposure is heavily concentrated on real estate loans including residential mortgage and home equity loans which represent 53.6% of the total segment loan portfolio combined in H1 2024. The company’s total loan average growth for the segment is 12.6% but is only -0.42% excluding 2019 following the merger. Most of its segment’s average growth had been negative, except for residential mortgages and Other Consumer loans. Other Consumer loans, which include personal loans, had the highest average growth of 11.82% and represented 23.9% of the total segment loans. This was mainly contributed by the strong growth in 2023 of 57%. On the other hand, its Home Equity loan growth declined by 60% that year, as the company reclassified its Home Equity segment which was previously Home Equity and Direct, and also recategorized its Other Consumer segment to include unsecured loans for activities related to “finance home improvements, furniture purchases, certain elective health-care services, and other consumer products segments”. Overall, we believe this highlights its large exposure in the real estate market. In the first point, we highlighted that the company focuses on the South and Northeast regions of the US. The South region has the second-highest homeownership rate in the US in 2023 at 67.5% which bodes well for the company, but it’s the Northeast region that has the second-lowest homeownership rate of 62.4%, below the national average of 65.9%.

Loan Portfolio Breakdown – Corporate & Commercial Segment

|

Corporate & Commercial Segment Loan Breakdown ($ mln) |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

H1 2024 |

Average 9Y |

Average 9Y (Excluding 2019) |

|

Commercial and Industrial |

55,281 |

59,416 |

61,064 |

63,953 |

136,302 |

143,594 |

138,762 |

164,307 |

160,788 |

156,400 |

||

|

Growth % YoY |

7% |

3% |

5% |

113% |

5% |

-3% |

18% |

-2% |

-6% |

18.3% |

4.75% |

|

|

Commercial Real Estate |

14,580 |

15,945 |

17,173 |

16,808 |

26,832 |

26,595 |

23,951 |

22,676 |

22,570 |

21,730 |

||

|

Growth % YoY |

9% |

8% |

-2% |

60% |

-1% |

-10% |

-5% |

0% |

-5% |

7.2% |

-0.24% |

|

|

Commercial Construction |

3,732 |

3,819 |

4,090 |

4,252 |

6,205 |

6,491 |

4,971 |

5,849 |

6,683 |

7,787 |

||

|

Growth % YoY |

2% |

7% |

4% |

46% |

5% |

-23% |

18% |

14% |

31% |

9.1% |

3.79% |

|

|

Corporate and Commercial Banking Loans |

73,593 |

79,180 |

82,327 |

85,013 |

169,339 |

176,680 |

167,684 |

192,832 |

190,041 |

185,917 |

||

|

Growth % YoY |

8% |

4% |

3% |

99% |

4% |

-5% |

15% |

-1% |

-5% |

15.9% |

3.95% |

Source: Company Data, Khaveen Investments

In terms of Corporate and Commercial Banking Loans, commercial and industrial real estate loans, which involve business financing for various aspects of operations such as working capital and equipment leasing, which represent the largest of its total segment loan portfolio of 85% in H1 2024. Moreover, its average loan growth excluding 2019 of 4.75% is the highest among other loan types. In the past 10 years, the total average growth rate of Commercial and Industrial Loans of all commercial banks in the US was 5.9%, fairly in line with the company’s Commercial and Industrial loan growth performance. However, there was a growth slowdown in 2023 and H1 2024 as its loans contracted. During Q2 2024, management highlighted the decline in Corporate and Commercial loans was driven by lower capital markets activity, likely as a result of rising interest rates, which increased the borrowing costs for debt funding.

Asset Quality Ratios

Furthermore, we compile and analyze the company’s and the other top 10 regional bank competitors’ Asset Quality ratios including the NPL ratio, loan loss ratio, and provision coverage ratio.

|

Companies |

Non-Performing Loans % |

Loan Loss Ratio (Loan Loss Reserves/ Total Loans) |

Provision Coverage Ratio (Provisions / Gross NPLs) |

Non-Performing Loans % Ranking |

Loan Loss Ratio Ranking |

Provision Coverage Ratio (Provisions / Gross NPLs) Ranking |

Overall Asset Quality Ranking |

|

Truist |

0.4% |

8.5 |

0.8 |

2 |

7 |

4 |

4.3 |

|

PNC |

0.8% |

7.5 |

2.5 |

9 |

9 |

1 |

6.3 |

|

US Bancorp |

0.5% |

8.2 |

1.3 |

3 |

8 |

2 |

4.3 |

|

First Citizen |

0.6% |

36.5 |

0.6 |

6 |

2 |

7 |

5.0 |

|

Fifth Third Bancorp |

0.6% |

12.3 |

0.8 |

4 |

4 |

3 |

3.7 |

|

M&T |

1.9% |

13.0 |

0.2 |

10 |

3 |

10 |

7.7 |

|

Huntington Bancshares |

0.6% |

11.9 |

0.8 |

5 |

5 |

5 |

5.0 |

|

Regions Financial Corp |

0.7% |

9.6 |

0.6 |

7 |

6 |

8 |

7.0 |

|

Citizens |

0.7% |

7.0 |

0.5 |

8 |

10 |

9 |

9.0 |

|

East West Bancorp |

0.3% |

37.3 |

0.6 |

1 |

1 |

6 |

2.7 |

|

Average Regional Firms |

0.7% |

15.2 |

0.9 |

N/A |

N/A |

N/A |

N/A |

|

Average Top Financial Firms |

0.91% |

14.2 |

1.41 |

N/A |

N/A |

N/A |

N/A |

Source: Company Data, Khaveen Investments

Based on the table above, Truist has the 2nd lowest non-performing loans % loans at 0.4%, almost half the regional average at 0.7%, a lower NPL % indicates better loan quality, thus we believe highlights Truist’s asset quality strength compared to the average. Moreover, Truist’s NPL ratio is also lower compared to the top Financial firms’ average of 0.91%. However, Truist’s loan loss ratio of 8.5, loan loss reserves divided by its total loans, was around half of the regional average of 15.2 and the top financial firms’ average of 14.2, a lower loan loss ratio indicates less aggressive provisioning for loan losses. Therefore, this may indicate that Truist is less conservative compared to competitors. Additionally, Truist’s provision coverage ratio of 0.8% is in line with the regional average but significantly below the average of top financial firms. A higher provision coverage ratio indicates more conservative provisioning compared to loan losses. Overall, we ranked Truist 4th compared to competitors, as the company has strengths in terms of low non-performing loans. However, it is also less conservative with provisions for loan losses than competitors.

|

Truist |

2020 |

2021 |

2022 |

2023 |

Average |

|

Non-Performing Loans % |

0.4% |

0.4% |

0.4% |

0.4% |

0.4% |

|

Loan Loss Ratio |

6.5 |

11.5 |

10.8 |

5.3 |

8.5 |

|

Provision Coverage Ratio (Provisions / Gross NPLs) |

1.8 |

-0.7 |

0.7 |

1.5 |

0.8 |

Source: Company Data, Khaveen Investments

Based on the table above, Truist Non-Performing Loans had remained constant and stable across the past 4 years, at an average of 0.4%. Furthermore, its Loan Loss Ratio has increased in 2021 compared to 2020 but has moderated down in 2023. Also, its Provision Coverage Ratio was more volatile as it fluctuated over the past 4 years. Overall, we believe the company’s NPL loan % which has consistently been stable highlights its strong asset quality.

Outlook

All in all, we believe Truist overall has strong asset quality as measured by its low NPL ratio. We believe this is significant as the company is concentrated in Consumer and Corporate & Commercial segments following the divestiture of its insurance business segment, where we highlighted the key growth drivers for the company is interest income. Additionally, we analyzed the company’s loan portfolios by segment and highlighted its high exposure in the Consumer segment to the real estate market, where we believe its focus on the southern region of the US, in particular, could bode well for the company due to higher-than-average national homeownership rates over there. However, as mentioned in our first point, PNC is also a major competitor in the region due to its wider presence of operations and its larger number of bank branches compared to Truist. Additionally, we believe the company’s main exposure to Commercial and Industrial loans is positive, as evidenced by its past robust performance that is in line with the average growth of the total US commercial and industrial loans.

Credit Quality of Fixed Income Comparison

Finally, we examine how the company’s credit rating and yield as one of the top regional banks compare with other regional banks and top Financial companies.

We compile both the yield of the company’s coupon bonds as well as the company’s credit rating and compare the average with the top 10 regional banks and 10 Financial competitors and determine whether its credit rating is decent and whether its yield relative to its credit rating is attractive.

Coupon Rating and Seniority

|

Truist Fixed Income (ISIN) |

Coupon Rate |

Seniority Rating |

Ranking |

|

US89832QAB59 |

8.70% |

Junior Subordinated |

6 |

|

US89788MAQ50 |

7.16% |

Senior Unsecured |

3 |

|

US89788MAK80 |

6.12% |

Senior Unsecured |

3 |

|

US89788MAN20 |

6.05% |

Senior Unsecured |

3 |

|

US867914AH65 |

6.00% |

Subordinated Unsecured |

5 |

|

US89788MAJ18 |

5.90% |

Senior Unsecured |

3 |

|

US89788MAP77 |

5.87% |

Senior Unsecured |

3 |

|

US89788MAS17 |

5.71% |

Senior Unsecured |

3 |

|

US89788MAM47 |

5.12% |

Senior Unsecured |

3 |

|

US89788NAA81 |

4.92% |

Subordinated Unsecured |

5 |

|

Average |

6.16% |

Source: Cbonds, Khaveen Investments

Based on the seniority hierarchy which we previously discussed in the coverage of JPMorgan, Truist’s top 10 bonds which we selected based on coupon rates include mainly senior unsecured bonds (7/10) with only 3 bonds rating subordinated unsecured. To add on, seniority ranking refers to the order in which creditors are paid, in the event of liquidation or bankruptcy. Based on the table above, most of Truist’s Fixed Income bonds are senior unsecured (7/10), and thus bondholders of these seniority ratings will be paid first after depositors and employees are paid but before equity holders.

Top Financial Competitors

|

Company |

Average Coupon Rate |

Fitch |

Moody’s |

S&P |

Average Credit Rating Score |

Coupon Rate to Credit Rating Score Ratio |

|

JPMorgan (JPM) |

7.930% |

AA- |

A1 |

A- |

5.3 |

1.49% |

|

Bank of America Corporation (BAC) |

7.122% |

AA- |

A1 |

A- |

5.3 |

1.34% |

|

Wells Fargo (WFC) |

6.785% |

A+ |

A1 |

BBB+ |

6.0 |

1.13% |

|

Citigroup (C) |

7.155% |

A |

A3 |

BBB+ |

7.0 |

1.02% |

|

HSBC (HSBC) |

5.986% |

A+ |

A3 |

A- |

6.3 |

0.95% |

|

Morgan Stanley (MS) |

5.833% |

A+ |

A1 |

A- |

5.7 |

1.03% |

|

Goldman Sachs (GS) |

7.320% |

A |

A2 |

BBB+ |

6.7 |

1.10% |

|

UBS Group (UBS) |

4.376% |

A |

A3 |

A- |

6.7 |

0.66% |

|

Deutsche Bank (DB) |

6.546% |

A- |

A1 |

A |

6.0 |

1.09% |

|

Barclays (BCS) |

4.842% |

A |

Baa1 |

BBB+ |

7.3 |

0.66% |

|

Average Top Financial Firms |

6.390% |

6.2 |

1.05% |

|||

|

Truist |

6.155% |

A- |

Baa1 |

A- |

7.3 |

0.84% |

Source: Fitch, Moody, S&P, Company Data, Khaveen Investments

From our previous analysis, the average top financial firms’ coupon rate, credit rating score, and coupon rate to credit rating score are all moderately higher compared to regional bank firms. However, when comparing Truist with the top Financial firms, we see that Truist could also offer a similar risk-to-return profile to the top financial firms, as Truist’s coupon rate to credit rating ratio of 0.97% is fairly in line with the top financial firms average of 1.05%. Additionally, Truist’s coupon rate to credit rating ratio is better than UBS and Barclays. Furthermore, Truist’s average credit rating score of 7.3 is slightly lower than the average of top financial firms, indicating its conservative credit quality assessment by credit rating agencies.

Regional Bank Comparison

|

Company |

Average Coupon Rate |

Fitch |

Moody’s |

S&P |

Average Credit Rating Score |

Coupon Rate to Credit Rating Score Ratio |

|

PNC |

6.108% |

A+ |

A2 |

A |

5.7 |

1.08% |

|

US Bancorp |

6.003% |

A+ |

A3 |

A |

6.0 |

1.00% |

|

Truist |

6.155% |

A- |

Baa1 |

A- |

7.3 |

0.84% |

|

First Citizen |

4.698% |

BBB |

Baa2 |

BBB+ |

8.7 |

0.54% |

|

Fifth Third Bancorp |

5.723% |

A- |

A3 |

A- |

7.0 |

0.82% |

|

M&T |

5.675% |

A |

Baa1 |

BBB |

7.7 |

0.74% |

|

Huntington Bancshares |

4.633% |

A- |

A3 |

A- |

7.0 |

0.66% |

|

Regions Financial Corp |

5.261% |

A- |

Baa1 |

BBB+ |

7.7 |

0.69% |

|

Citizens |

5.644% |

BBB+ |

Baa1 |

A- |

7.7 |

0.74% |

|

Average Regional Firms |

5.544% |

7.3 |

0.79% |

|||

|

Average Top Financial Firms |

6.390% |

6.2 |

1.05% |

Source: Fitch, Moody, S&P, Company Data, Khaveen Investments

Based on the table above, Truist’s average coupon rate is significantly above the regional average of 5.5%, and the highest among competitors, but slightly lower compared to the top financial firms’ average. Moreover, Truist’s average credit rating score is in line with the regional average and in line with top financial firms’ average, Truist’s average coupon rate to credit rating score of 0.84% is also in line with the regional average of 0.79% but below that of top financial firms’ average. Importantly, Truist’s Fitch and Moody’s credit ratings are lower than its competitor PNC.

We examined the company’s credit rating by Fitch, Moody’s, and S&P and highlighted three main positive points for Truist’s rating. Firstly, the rating agencies highlighted the company’s capital adequacy improved as its CET1 ratio increased from 10.1% to 11.4%, following the sale of its insurance segment, Truist Insurance Holdings, which accounted for 14% of its FY2023 revenue. Secondly, the sale enhanced Truist’s asset liquidity, generating $10.1 bln in after-tax proceeds. Thirdly, the quality of Truist’s investment portfolio improved as the company sold off its low-coupon investment securities at a loss and reinvested a portion of the $10.1 bln gained into higher-current-coupon and shorter-duration investments. Based on the Q2 earnings transcript, the sale of both its insurance segment ($10.1 bln after-tax) and lower-yielding investment securities ($29.3 bln after-tax) had been reinvested ($18.7 bln invested, $20.7 in cash) and had increased its previous securities yield from 2.80% to the current blended 5.27%. However, the rating agencies also emphasized three main negative points for Truist’s rating. The sale of Truist Insurance Holdings led to increased revenue concentration in net interest income. Additionally, this increases the company’s revenue exposure to interest rates and associated risks. Furthermore, Truist faces high levels of unrealized security losses due to the Federal Reserve’s rising interest rates.

Conclusion

Truist’s relative top fixed income securities’ coupon rate to credit quality rating is lower than PNC and US Bancorp, but still higher than the average among the top regional bank competitors. Truist also has a relatively high credit quality rating, only behind PNC and US Bancorp, indicating its stronger stability than smaller regional banks. Additionally, we identified Truist’s relative coupon rate to credit rating score is in line with the average of top financial firms, and even its credit rating score is higher than the average of top financial firms, notably JPMorgan and Bank of America, indicating its strong credit quality ratings.

Risk: Top Regional Bank Rivals

We believe the company’s main risk is competition with two of its key larger regional bank competitors, which are US Bancorp and PNC Financial. As mentioned above, we derived a competitive ranking where we see PNC Financial leading Truist, competing in overlapping regions such as the South and Northeast regions with an advantage in terms of accessibility due to its higher number of bank branches and states it operates in. Furthermore, we believe US Bancorp is another main competitor with an advantage due to its focus on the West and Midwest regions of the US and also its expansions into the East Coast.

Verdict

All in all, following the divestiture of its Insurance segment, we expect the company will now rely mainly on its Consumer segment, which, along with the Corporate & Commercial segment, has experienced growth largely due to net interest income, highlighting its dependence on lending businesses. We believe Truist holds competitive advantages over other regional banks, such as high customer satisfaction and attractive savings rates, and overall trailing behind only PNC Financial and US Bancorp. In terms of asset quality, we believe Truist demonstrates strong asset quality with a low NPL ratio, which is significant given its concentration in the Consumer and Corporate & Commercial segments post-divestiture. The company’s Consumer segment is highly exposed to the real estate market, particularly in the South US, where higher-than-average homeownership rates could benefit Truist. Finally, Truist’s fixed-income securities have a lower coupon rate relative to credit quality compared to PNC and US Bancorp but are still above the average for top regional banks. Its high credit quality rating, only behind PNC and US Bancorp, indicates stronger stability than smaller regional banks. Additionally, Truist’s relative coupon rate to credit rating is in line with top financial firms, and its credit rating score surpasses that of firms like JPMorgan and Bank of America, indicating strong credit quality ratings.

link